Compensation Discussion and Analysis(continued)

Long-Term Incentives:Stock Options. Stock options provide our employees, including NEOs, with the opportunity to participate in stockholder value created as a result of stock price appreciation, which furthers our objective of aligning the interests of management with the interests of our stockholders.

Awards IssuedAll stock options granted are non-qualified stock options, vest at a rate of one-third per year, with full vesting at the end of three years and have a term of ten years. A description of the terms under our incentive plans related to the treatment of stock options upon termination of employment can be found under the heading “Potential Payments Upon Termination or a Change in Control” on page 78 of this Proxy Statement.

Performance Share Program. PSP awards are intended to reward NEOs to the extent we achieve specific pre-established financial performance goals and provide a greater long-term return to stockholders relative to a broader market index. The PSP provides grants of performance share units, which key officers and executives may earn if we meet specified performance objectives over a three-year period. PSP awards are paid out in stock and cash in three annual installments following the end of a three-year performance period. Forty percent of the award is based on the achievement of specified levels of income before taxes, 30% on the achievement of specified levels of revenue, and 30% on the achievement of specified levels of return to stockholders relative to an index. The PSP award is expressed as a percentage of the participant’s base salary as of the date that the award is granted. The percentage may be increased on a prorated basis during the award cycle in the case of promotions. In January 2017,addition, changes to base salaries during the Personnelterm of the award are not factored into the calculation except in the case of promotion.

Beginning with the 2021-2023 performance cycle, the Company discontinued the PSP, which provided for awards made every three years, and Compensation Committee approvedtransitioned to a Performance Plan, which will provide for overlapping three-year performance periods, with cash payouts, if any, following the grantend of each three-year performance period.

Performance-Based Restricted Stock Award Program. The performance-based restricted stock award program provides for awards of performance-based restricted stock, and service-based stock option awards,generally each calendar year, to NEOs at levels consistent with prior award levels. The other componentan aggregate fair market value equal to a percentage of our long-term incentive program, the PSP, is issued on a triennial basis, with the next PSP cycle having been established in 2018.

Awards Earned

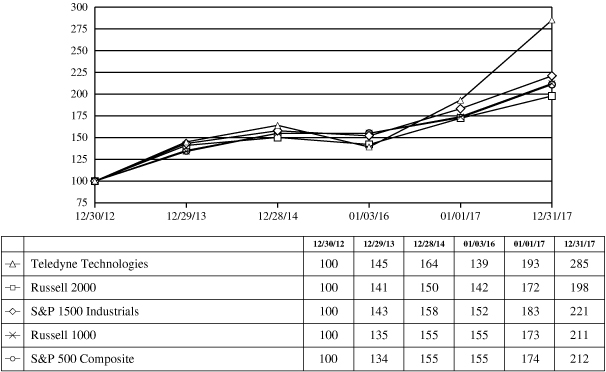

During the three-year period ended December 31, 2017, Teledyne’s stock price growth was 138%each recipient’s annual base salary as of the growth indate of the Russell 2000 Indexgrant, unless otherwise determined by the Committee. The shares of restricted stock are subject to both time-based and performance-based restrictions. In general, the restricted period for each award of performance-based restricted stock extends from the same period. As a result, ondate of the grant to the third anniversary of such date, with the daterestrictions lapsing in full on the third anniversary. However, unless the Committee determines otherwise, if we fail to meet certain minimum performance goals for a multi-year performance cycle (typically three years) established by the Committee, then all of grant, February 17, 2018, participants in Teledyne’s performance-basedthe restricted stock program vestedwould be forfeited. If we achieve the minimum performance goals but fail to attain an aggregate level of 100% of the 2015targeted performance goals, then a portion of the restricted stock award, which had satisfied the three-year performance period ended December 31, 2017.would be forfeited.

Also during the three-year period ended December 31, 2017, the performance periodSee 2020 Compensation Decisions for the 2015-2017 cycleNamed Executive Officers beginning on page 50 for details of the PSP ended. In January 2018, the Personnel and Compensation Committee determined that 101.2% of the target performance was met. The awards under this PSP will be paid out in three annual installments in 2018, 2019 and 2020. Generally, under the PSP, in order to receive the payment, an executive must be employed when payments are made.

Commitment to Best Practices:

The Personnel and Compensation Committee periodically reviews its compensation policies and practices in light of best practices and makes appropriate adjustments when necessary.

Teledyne seeks to develop pay programs that are reflective of good corporate governance. Among other things:

we do not guarantee bonuses, or equity awards, outside of certain negotiated,one-time new hire situations;

we do not exercise discretionary upward adjustment to incentive awards for named executives;

base salaries and other components of compensation are informed by external market conditions, including peer group data provided by independent compensation consultants, and are approved by the Personnel and Compensation Committee, which consists entirely of independent directors;

performance incentive awards are capped and there will be no payout if minimum performance goals are not achieved;

executive perquisites that are generally not available to other employees are minimal — and in the case of our Chief Executive Officer limited to a car allowance;

we have neverre-priced stock options;

our insider trading policy prohibits the pledging or hedging of company stock by directors and executive officers;

we have stock ownership guidelines for key executive officers and directors; and

we have a formal policy related to the “clawback” of incentive compensation in the event of a material financial misstatement or in the event of fraud or criminal misconduct.

Personnel and Compensation Committee

The Personnel and Compensation Committee reviews and administers the compensation for the Chief Executive Officer and other members of senior management, including the named executives. In the case of the Chief Executive Officer, the compensation determination made by the Personnel and Compensation Committee is reviewed by the entire Board. The Personnel and Compensation Committee is composed exclusively ofnon-employee, independent directors that meet the approval requirements of Section 162(m) of the Internal Revenue Code and Section 16 of the Securities Exchange Act of 1934. The Personnel and Compensation Committee retained the compensation consultant Exequity LLP to assist the Personnel and Compensation Committee in fulfilling its responsibilities in 2017. The services that Exequity LLP performed for Teledyne were related to executive and director compensation and were primarily in support of decision-making by the Personnel and Compensation Committee and, in the case of director compensation, the Nominating and Governance Committee. No other services were provided by Exequity LLP for the Company. In January 2017 and again in January 2018, the Personnel and Compensation Committee conducted a conflict of interest assessment of Exequity LLP, and no conflicts of interest were identified resulting from retaining Exequity LLP. In reaching these conclusions the Personnel and Compensation Committee considered factors set forth in applicable rules promulgated by the SEC.

TELEDYNE TECHNOLOGIES INCORPORATED|2018 Proxy Statement 25

We do not guarantee bonuses, or equity awards, outside of certain negotiated, one-time new hire situations (no such situations existed for NEOs in 2020)

We do not guarantee bonuses, or equity awards, outside of certain negotiated, one-time new hire situations (no such situations existed for NEOs in 2020)